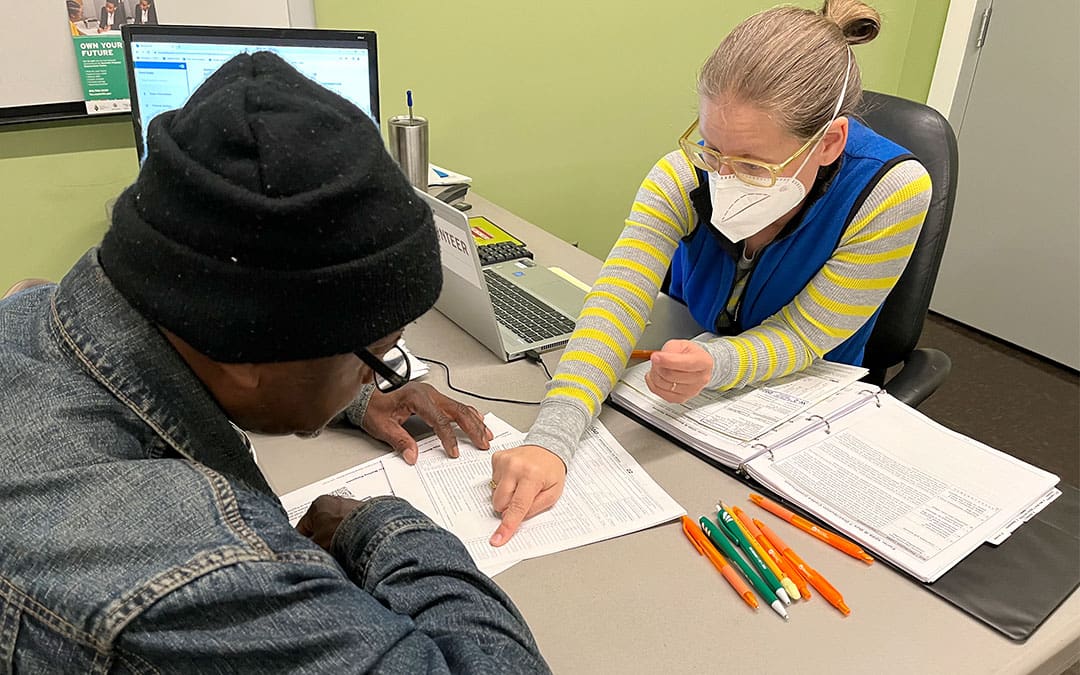

The Volunteer Income Tax Assistance (VITA) program is a crucial resource for thousands of Middle Tennessee residents, offering free tax preparation services to asset-limited households. The 2023 tax season (filed in 2024) marked a significant milestone, both in the number of filed tax returns and the financial impact within our community.

VITA volunteers prepared 9,309 tax returns, surpassing the 8,879 returns completed during the previous tax season. What makes this achievement even more impressive is that the 9,309 tax returns were completed between February and May 2024, excluding any returns that will be filed through the October IRS extension. This early success reveals a promising trend that we could exceed our ambitious goal of 10,000 returns for the year.

The financial benefits of our VITA free tax prep program extend far beyond the number of filed returns. This year, VITA volunteers brought $10,316,875 in tax refunds back to our community, representing a 22% increase from last year. This increase in refund dollars is a testament to the growing reach of the program and the increasing need for this vital resource. Furthermore, certified tax preparers saved local families approximately $2,558,585 in tax preparation fees, up from $1,850,750. These savings offer a financial cushion for households facing the rising costs of living.

“Many times, I have called our tax sites reality changers,” shared Bonnie Bowles, our VITA regional manager.

“Often our taxpayers are surprised to receive refunds, while at other times, they are surprised to owe taxes. Whatever their situation, VITA staff and volunteers are confident in bringing them a quality service free of charge, making whatever reality they face a little sweeter or, in the very least, less of a burden.”

The clients served by VITA highlight the importance of these savings. The average adjusted gross income (AGI) of those served in the 2023 tax season was $32,415, a modest increase from the $31,560.98 average AGI in 2022. This slight income rise must be viewed in the context of increasing consumer prices and a sharp rise in rent. In our region, consumer prices increased by 3.4% last year, while rental prices in Tennessee surged by 12%, according to a March 2023 report from Rent.com.

For many families, financial pressures are compounded by the challenges of qualifying for the Earned Income Tax Credit (EITC), a key target demographic for our program. Sixteen percent of those served by VITA qualified for the EITC, up from 13% the previous year. This increase demonstrates VITA’s growing focus on reaching those who stand to benefit the most from tax credits. Our VITA and Marketing teams are working together to increase this percentage, with the goal of reaching 36% of EITC qualifiers next year.

“Seeing the relief that the Earned Income Tax Credit and Child Tax Credit bring to deserving families is worth every piece of paperwork VITA brings your way!” Bonnie added. “For many families, it can mean the difference of having or not having enough savings to get you through an entire year.”

The VITA program’s growth underscores its role within our community. This year, our team and partners managed 20 VITA sites across a 30-county footprint, in addition to virtual filing options. As United Way of Greater Nashville looks ahead to next tax season, the focus remains on expanding the program’s reach and impact, with the goal of empowering even more individuals and families to achieve financial stability. The VITA program is a continued beacon of support that demonstrates how a community-driven program provides essential financial relief.